Imagine waking up to the news that your business has suffered a data breach.

Critical personal information of customers, such as social security numbers and credit card details, has fallen into the hands of cybercriminals. This scenario isn’t just a nightmare; it’s a harsh reality that managed service providers see for an increasing number of businesses today.

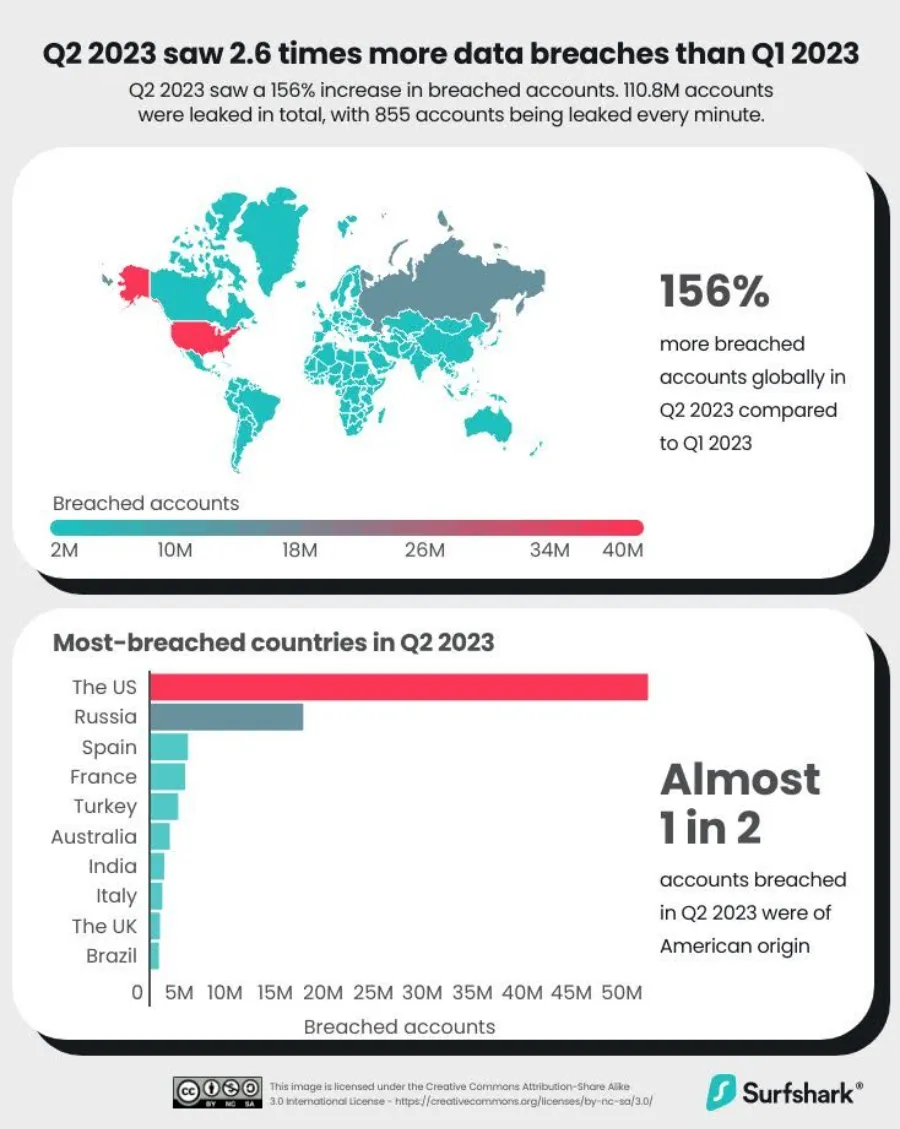

The latest study by Surfshark shows that a total of 31.5M accounts were breached in Q3 2023, with the United States ranking first and amounting to around a quarter of all breaches.

| As David Stanton, Head of Cybersecurity/CISO, says “Data breach insurance is more than just a good idea; it’s a blanket of security for your business.” |

In this blog, we will explore data breach insurance and how it’s becoming more commonplace in protecting the businesses of today. We’ll explore what data breach insurance is, what it covers, and why it’s an indispensable part of your business’s defense strategy against these modern digital risks.

What is a Data Breach?

A data breach is an incident where confidential, sensitive, or protected data is accessed or disclosed without authorization. This can include a variety of personal information such as social security numbers, credit card details, and health records.

Breaches can occur due to various reasons, ranging from:

- Intentional cyberattacks like DDoS or ransomware attacks

- Accidental exposure or leak of data

- Human error, such as mistakes made by employees

- Mishandling of data

The impact of a data breach can be devastating, leading to loss of customer trust, financial losses, and potential legal consequences.

What is Data Breach Insurance?

Data breach insurance, also referred to as cyber data breach insurance, is a specialized form of business insurance. It is designed to help businesses manage the risks and mitigate the financial impact of a data breach.

This insurance typically covers expenses related to responding to a breach, such as credit monitoring services for affected individuals, public relations efforts to manage reputation damage, legal fees, and compensation for fines or penalties imposed due to the breach.

Data breach insurance is a proactive measure for businesses to protect themselves from the potentially crippling costs of a cyber incident.

Why is Insurance Against Data Breach So Important for Business Owners?

We live in a world where every click, every online transaction, and every digital record is a potential entry point for cyber threats. As an MSP, threat detection and mitigation is your first line of defence, but data breach insurance steps in as a vital shield in these turbulent times.

Even with security protocols in place, cyber attacks do takeresearch shows that the average time to identify and contain a data breach globally is 204 days, with the containment phase averaging 73 days.

When a data breach strikes, this insurance kicks into action, providing a much-needed financial lifeline that helps businesses bounce back with speed and agility. But the benefits extend beyond mere monetary support. This insurance serves as a promise to customers and clients, a promise that in the event of a breach, their interests and data will be protected.

Investing in data breach insurance goes beyond protecting the present; it sends a powerful message about a business’s foresight and commitment to data security.

What Does Data Breach Insurance Cover?

Data breach insurance coverage, includes both first-party and third-party liabilities. Let’s break down what each of these entails:

First-Party Coverage:

Notification Costs: Covers expenses for legally required notifications to affected parties. This includes communication costs via mail, phone, or other means.

Public Relations: Funds PR campaigns to manage reputation and restore trust post-breach. Crucial for maintaining customer confidence and business image.

Business Interruption: Compensates for lost income if operations are halted due to a breach. Essential for financial stability during recovery.

Digital Data Restoration: Involves costs for recovering or replacing lost or corrupted digital data. Vital for businesses reliant on digital information.

Cyber Extortion: Covers negotiations and payments in ransomware or similar extortion scenarios. Protects against financial losses due to cyber threats.

Crisis Management: Funds hiring of specialists for breach aftermath management. Includes consultants and legal advisors specialized in cyber incidents.

Forensic Analysis: Pays for investigations to determine the cause and extent of the breach. Helps in understanding and preventing future incidents.

Third-Party Liability:

Defense Costs: Covers legal defense fees if sued due to a data breach. Essential for handling expensive legal proceedings.

Settlements and Judgments: Pays for court-ordered compensations or settlements. Protects against financial burdens from legal judgments.

Regulatory Compliance Fines: Helps pay regulatory fines and penalties for non-compliance with data protection laws. Critical for businesses operating under stringent data regulations.

Network Security Liability: Protects against claims due to network security failures. Essential for mitigating legal risks from cyber vulnerabilities.

Media Liability: Covers claims related to defamation, libel, or intellectual property infringement in a breach. Important for businesses with significant media exposure.

Credit Monitoring & Identity Theft Protection: Offers services to affected individuals for monitoring and protecting against identity theft. Vital for customer protection and trust post-breach.

More resources you might like: |

Frequently Asked Questions About Data Breach Insurance

Is data breach insurance the same as general liability insurance?

No, general liability insurance does not typically cover cyber incidents. Data breach insurance is specifically designed to address the unique risks associated with data breaches and cyberattacks.

What factors determine the cost of data breach coverage?

The cost depends on several factors, including the type of business, the amount of sensitive data handled, and the company’s cybersecurity measures.

Can data breach insurance cover ransomware attacks?

Yes, many policies include coverage for ransomware attacks, helping to cover the costs associated with such incidents.

Does data breach insurance help enhance a company’s cybersecurity measures post-incident?

Yes, data breach insurance often plays a crucial role in strengthening a company’s cybersecurity posture after an incident. Along with providing cyber coverage for immediate financial losses due to data loss or a security breach, many insurers also offer resources and guidance to help businesses improve their cyber defenses.

Let Buchanan Technologies Be Your Guardian in the Cyber World

With over 35 years in the business, Buchanan Technologies stands as a reliable and seasoned ally in the complex world of cybersecurity. Understanding the immense challenges posed by data breaches, we are dedicated to being your stronghold in these critical moments.

Trusted Cybersecurity Services Near You |

Boasting a formidable team of 856+ IT experts, we pride ourselves on being GDPR and NIST compliant, ensuring that we meet the highest standards of data protection and security.

Your digital security is our highest priority. Reach out to Buchanan Technologies for a free consultation to strengthen your cyber defenses.